Liquidity

Abstraction

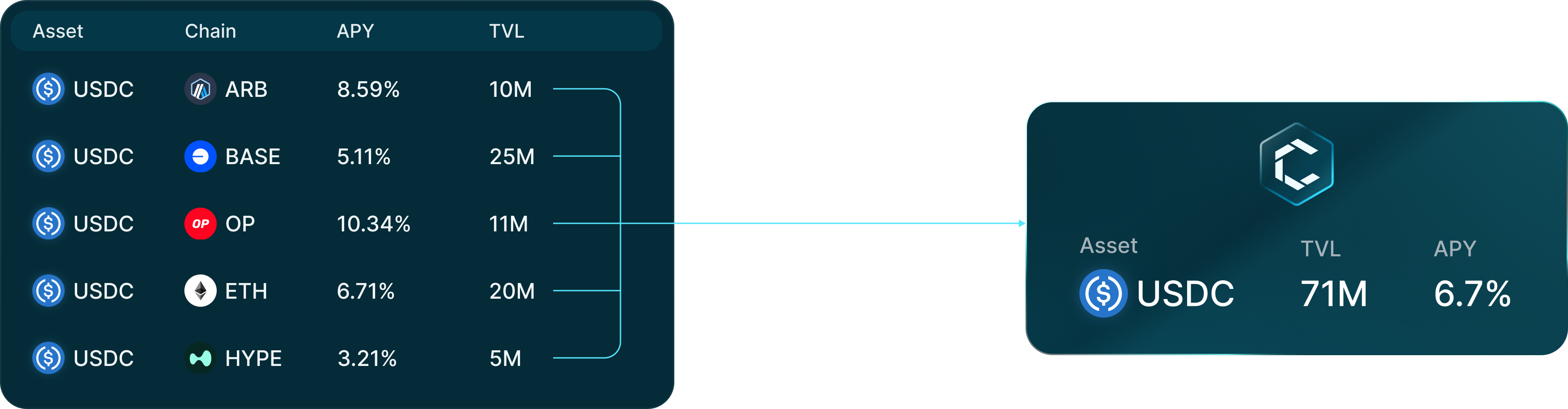

Unified liquidity. Stacked yields.

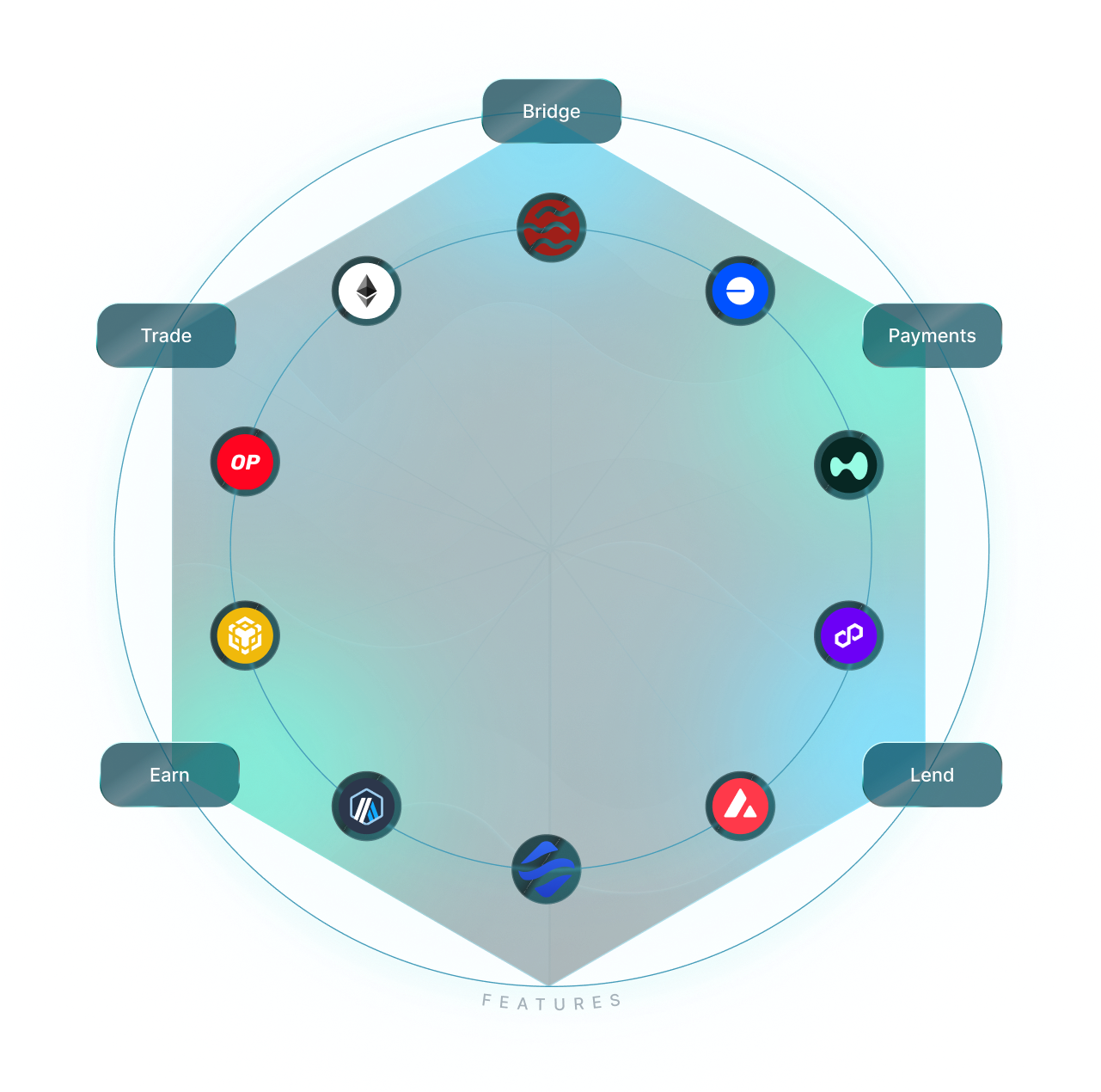

Any chain. Any asset.

One liquidity layer.

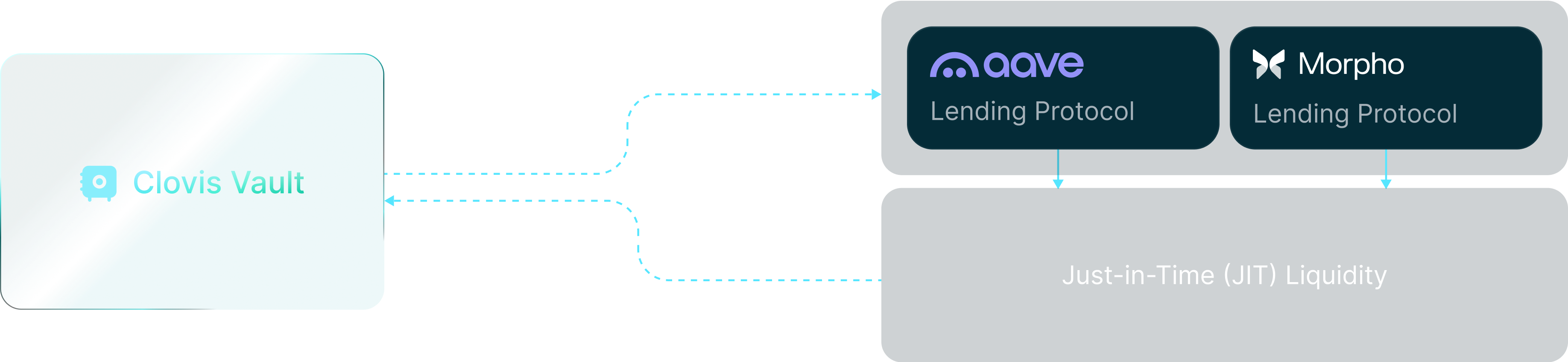

Zero idle capital.

Keep all your liquidity productive and unlock cross-chain yield opportunities with Clovis's unified engine.

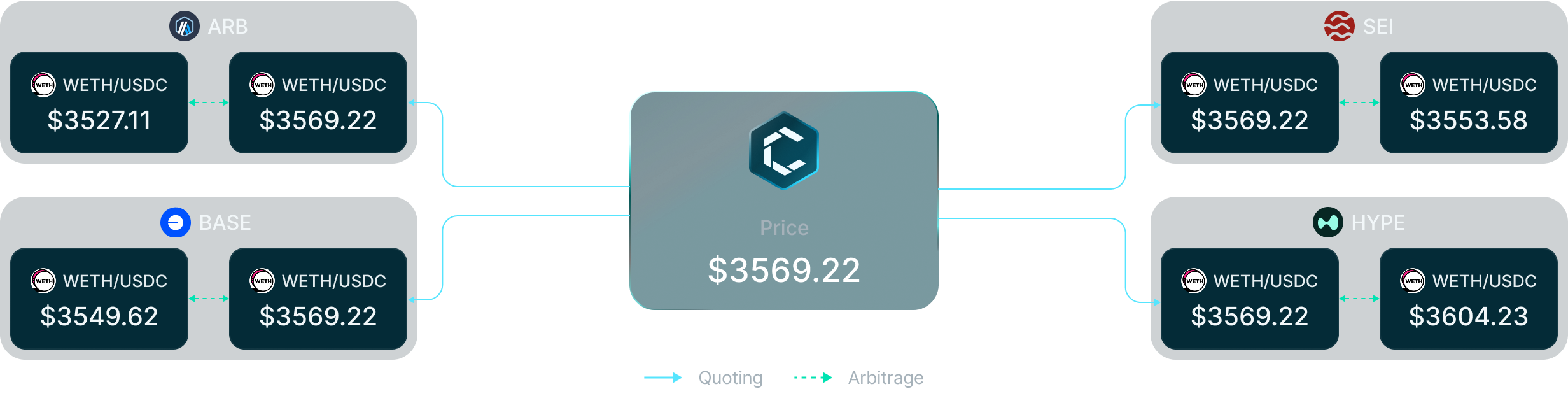

Hub-to-everywhere liquidity.

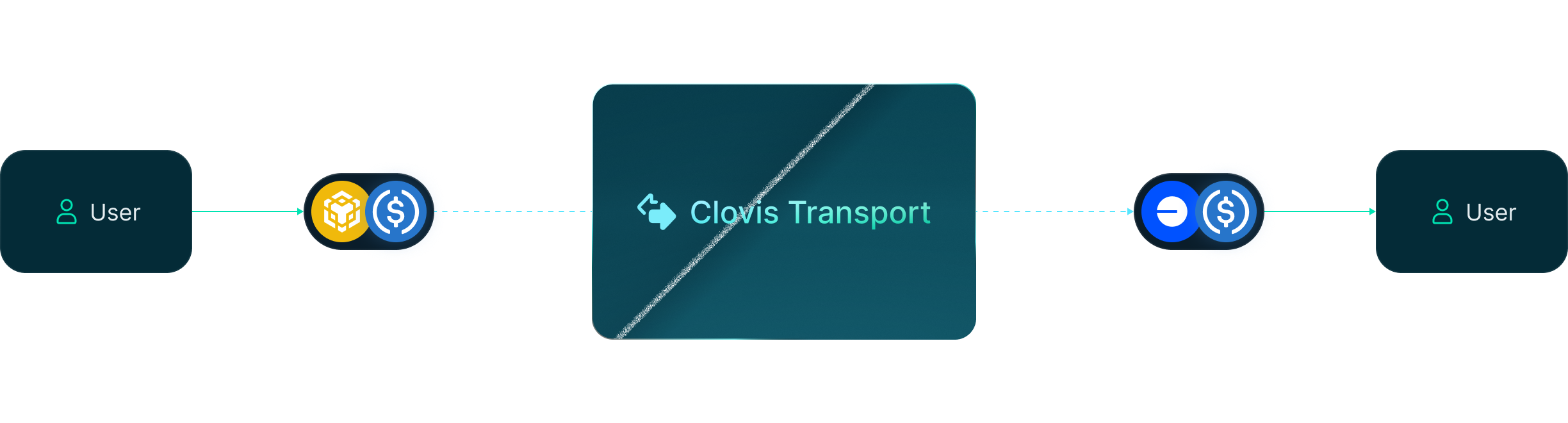

Clovis's hub-kept ledger, spoke-held liquidity, intent-based messaging, and auto-rebalancing work together so every swap, loan, and bridge clears instantly.

the cash, so swaps, loans, and bridges feel local but settle globally.

giving every network the same price and rate without double-moving money.

background, keeping every spoke solvent and every APR aligned.

The DeFi

Super App

What's next for Clovis?

Launch pre-deposit vaults

CLO TGE

Q4 2025

Clovis Mainnet launch on major EVM chains

Launch Clovis cross-chain lending markets

Launch Clovis decentralized cross-chain bridge

Support Wormhole and Layerzero for cross-chain messaging

H1 2026

Clovis expands to major non EVM chains, such as SVM, Move and Ton

Launch Clovis cross-chain DEX

Launch Clovis cross-chain messaging layer

Launch Clovis cross-chain yield optimization vault

Secure by Design

We teamed up with leading auditors to ensure peace of mind for all companies developing with Clovis.

Building with great Web3 companies